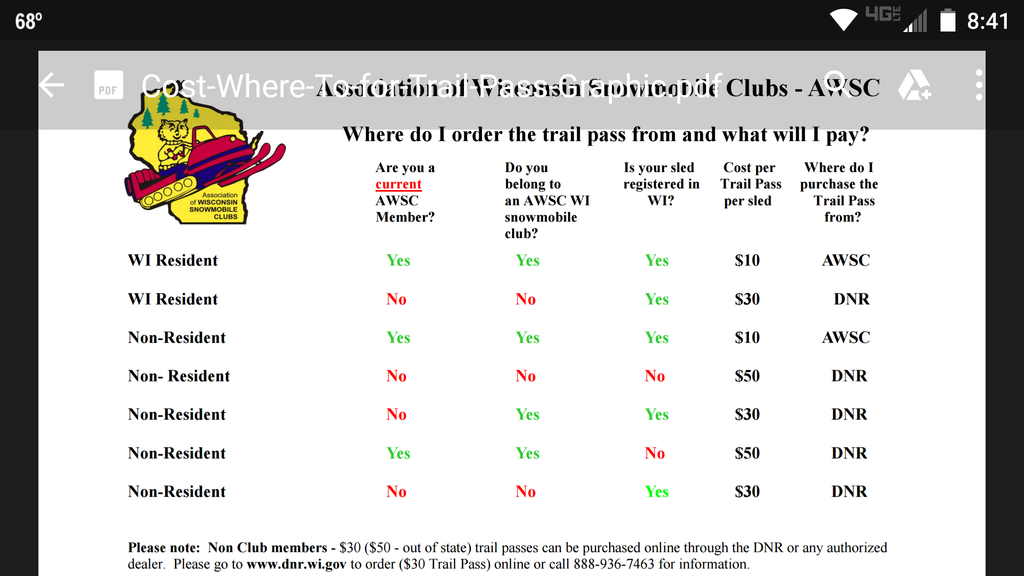

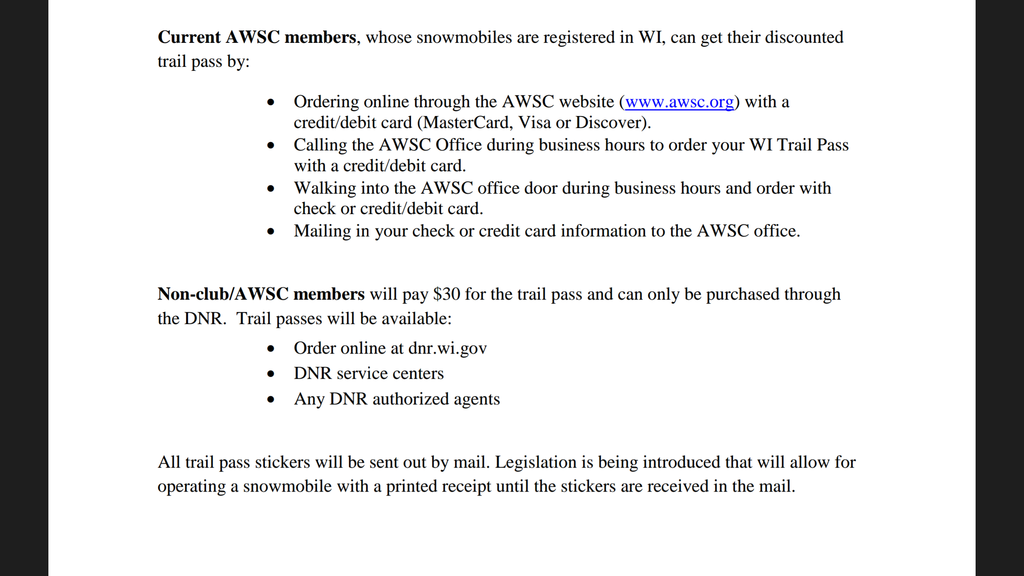

Sure has been a lot of confusion over this but just in the nick of time my copy of the Wisconsin Snowmobiler came in the mail. It's the magazine that's put out by the AWSC, Association of Wisconsin Snowmobile Clubs and the following picture details where to get your Trail Pass and how much it will cost.