just guess at mileage to and from and millage going to gym going to store to buy work clothes driving to dept related events get close and don't worry about it . deduct a least part of your phone . I would assume u will get that taxable income to less than 1200 bucks so what 300 or less prob less

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

tax question

- Thread starter hemi_newman

- Start date

hemi_newman

Active member

just guess at mileage to and from and millage going to gym going to store to buy work clothes driving to dept related events get close and don't worry about it . deduct a least part of your phone . I would assume u will get that taxable income to less than 1200 bucks so what 300 or less prob less

I do use my cell phone for fire dept purposes.

Spoken like a guy who sits around a firehouse with the guys thinking of every possible way to make a buck.Make sure you deduct your fuel, mileage on your truck or car (depreciation), your clothes, study material for firefighting (books, etc.), gym membership, cell phone bill, laudry detergent and dry cleaning to name a few. The government takes enough from us, you might as well get what you can in return.

To be able to claim any of those things you would need to have an itemized record. Just because you used your phone for work related business does not mean you cannot deduct it unless you have a running log of the exact date, times of the calls written down, you cannot guess at it. If you are ever audited and you don't have these records, you will pay tax and penalty. You have to keep records and judging by the question, its too late to worry about 2016. For 2017 Write down every expense and complete details as it occurs in real time.

I know someone who got audited and he had shoddy records of his business use of his vehicle that he claimed on his taxes, they denied the deduction and he owed back taxes +. Had to borrow money to pay it.

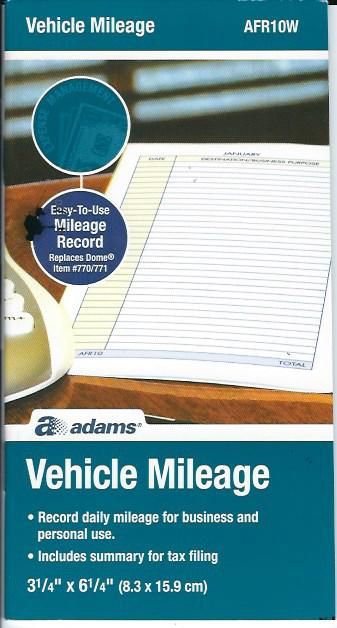

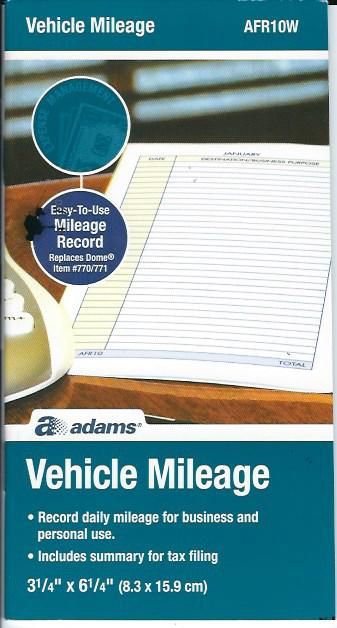

Get something like this, got this at Walmart.

I know someone who got audited and he had shoddy records of his business use of his vehicle that he claimed on his taxes, they denied the deduction and he owed back taxes +. Had to borrow money to pay it.

Get something like this, got this at Walmart.

Last edited:

snobuilder

Well-known member

And if you fill it out in one sitting, switch pens once in awhile.